Guides

Restaurant Costs 101

Running a restaurant is expensive. There are quite a few different cost areas that add up and eat into profit margins. While these costs remain important to restaurant operations, learning how to effectively manage them goes a long way towards increasing profits. This article covers the types of restaurant costs and tips for effectively managing them.

There are two common situations where you want to manage your restaurant costs better: before you open a new restaurant or when you’ve been open awhile but have noticed a noticeable shift in profitability.

Of course, getting a handle on your costs and expenses, from labor to food to utilities, is always a good idea. Understanding your restaurant costs and managing them to a budget can help ensure you can weather slower demand or fluctuating sales.

To better understand costs and expenses in the restaurant industry, it's important to know the difference between fixed and variable costs.

Fixed restaurant expenses are recurring payments that are made regularly and often for the same amount each month or year. On the other hand, variable or semi-variable restaurant costs aren’t as easy to plan for. They can be one-time expenses for items such as kitchen equipment, dishes, or furniture, or they can fluctuate depending on your operations.

We’ll get into all those details later on, but for now, if you’re hoping to better visualize and track costs to run a successful restaurant, know that you’re in the right place.

In this article, we will discuss the types of common restaurant costs and provide tips for managing them effectively.

The Different Types of Restaurant Costs

As a restaurant owner, you will encounter three main types of costs: fixed costs, variable costs, and semi-variable costs.

Fixed Costs

Fixed costs are expenses that do not vary with the level of business activity, such as sales or the number of customers. In a restaurant, fixed costs typically include the following:

- Rent or mortgage payments for the restaurant building or space

- Property taxes

- Insurance, including liability insurance and property insurance

- Salaries and wages for permanent staff, such as managers, chefs, and administrative staff

- Equipment costs, including buying or leasing kitchen equipment such as ovens, point-of-sale (POS) systems, and furniture

- Any recurring legal and accounting fees

- Licenses and permits, such as liquor licenses and health permits

- Any debts, including loan payments and interest charges

Fixed costs are easier to budget and plan for because you can expect them to stay the same month after month. Gathering all your monthly restaurant costs and filtering out your fixed costs into one group is a good place to start.

Grouping and tracking these together can ensure you’re not overpaying, missing a payment, or paying late fees. The goal is to keep these fixed costs as low as possible, which we’ll discuss more later.

Variable Costs

Variable costs are more of a wild card. Because they depend on usage and your restaurant’s operations, they are harder to plan for and manage. These variable expenses can change based on your sales volume, the number of customers and transactions, and more.

In a restaurant, variable costs typically include the following:

- Cost of goods sold (COGS), which includes the restaurant food costs, liquor and beverages, and any related supplies, such as napkins and condiments

- Labor costs, including hourly wages for staff such as servers, bartenders, bussers, and any temporary positions

- Credit card processing fees

- Cleaning and maintenance costs, including equipment costs and cleaning supplies

- Laundry and linen costs, including tablecloths and napkins

While fixed costs are important to monitor for any fluctuations or out-of-the-ordinary charges, variable costs need to be tracked because they can go up and down with sales and demand. Thus, they can directly impact the profitability of a restaurant as your costs may go up along with your revenue.

To keep variable costs under control, take a stronger approach to tracking inventory levels, optimizing restaurant staff scheduling, and negotiating with suppliers for the best prices.

Semi-Variable Costs

Semi-variable costs, also known as semi-fixed costs, are expenses with both fixed and variable components. In a restaurant, semi-variable costs can include the following:

- Wages and salaries for managers and supervisors, which may include a fixed salary plus bonuses or commissions based on performance

- Kitchen labor, which may include a fixed salary for chefs and a variable component for line cooks and prep cooks based on the number of hours worked

- Maintenance and repairs for equipment, which may include a fixed cost for routine maintenance or a maintenance plan, and a variable cost for unexpected repairs or replacement parts

- Advertising and marketing costs which may include a fixed cost for basic advertising and a variable cost for promotions, events, and social media management

- Utilities, such as gas, water, and electricity, may vary depending on usage. Other utilities, such as internet and garbage service, may be consistent amounts (and thus, closer to fixed costs), but for the most part, your utilities will vary from month to month.

Semi-variable costs can be more difficult to manage than fixed or variable costs because they require different strategies to control both the fixed and variable components. However, it’s still important to carefully monitor semi-variable costs and develop a budget that considers these charges.

Together, fixed costs, variable costs, and semi-variable costs make up the total operating costs for your restaurant.

Restaurant Operating Costs Breakdown

In addition to knowing your total restaurant costs, it’s important to understand costs as a percentage of revenue. Your food cost percentage and labor cost percentage are two of the biggest restaurant costs and expenses to manage, but you should also know what takes up the rest of your budget, as these can all eat into your profit margin.

Here is a breakdown of the typical operating costs for a restaurant:

1. Food and Beverage Costs

This includes the cost of all the ingredients and beverages used to create menu items. Food and beverage costs typically account for around 28% to 35% of a restaurant’s revenue.

Food costs include the expenses related to purchasing, storing, and preparing ingredients for the menu items. This involves factors like ingredient quality, portion control, waste reduction, and efficient inventory management. Monitoring food costs helps ensure that the restaurant is not overspending on ingredients and that menu pricing remains competitive while covering expenses.

Beverage costs encompass the expenses linked to purchasing and serving beverages, including alcoholic and non-alcoholic drinks. Just like with food costs, managing beverage costs involves aspects like pricing, portion control, inventory management, and optimizing the beverage menu to cater to customer preferences.

2. Labor Costs

This includes the cost of all the staff, such as servers, cooks, and dishwashers, as well as any associated payroll taxes and benefits. Restaurant labor costs can range from 25% to 35% of a restaurant's revenue. A good benchmark to aim for is keeping total labor costs less than 30% of revenue.

Efficient labor cost management involves smart scheduling, compliance with labor laws, training, and minimizing turnover. Striking a balance between staffing and service needs ensures cost-effectiveness while maintaining quality service.

3. Rent and Utilities

This includes the cost of the restaurant's lease or mortgage payment, as well as utilities such as electricity, gas, water, and internet. Rent and utilities typically account for around 5% to 10% of a restaurant's revenue.

The location, size, and type of space can all influence rent expenses. Negotiating favorable lease terms, considering the location's foot traffic and target market, and ensuring that the rent is sustainable within the overall budget are key considerations.

Efficient use of utilities, adopting energy-saving practices and technologies, and conducting regular maintenance to ensure optimal performance of equipment can help control utility expenses.

Both rent and utility costs contribute significantly to the restaurant's overhead. Effective restaurant management involves balancing the need for a suitable location and comfortable environment for customers with the need to keep costs under control.

4. Marketing and Advertising

This includes the cost of advertising the restaurant to attract new customers and ongoing promotions and loyalty programs to retain existing customers. Marketing and advertising costs can vary widely but typically range from 1% to 7% of a restaurant’s revenue, with 3-6% of sales being the most common.

Marketing costs could involve creating and printing menus, developing promotional materials, hosting events, and engaging in social media campaigns. Allocating the budget wisely across different marketing channels can maximize the restaurant's reach and impact.

Advertising costs cover expenses related to paid promotional efforts, such as online ads, radio spots, television commercials, and print advertisements. Selecting the right advertising platforms and optimizing campaigns based on target demographics can help ensure that the advertising budget generates a favorable return on investment.

5. Insurance

This includes various types of insurance to protect the restaurant's assets, employees, and customers. Insurance costs can hover around 1% to 3% of a restaurant's revenue, or in this example, around $9,000 annually.

Proper insurance coverage is essential for mitigating risks and ensuring the restaurant's financial security.

Insurance Costs

Insurance costs encompass various types of coverage that a restaurant might need, including:

Property Insurance

This covers damage to the restaurant's physical property, such as the building, equipment, and furnishings, due to events like fires, storms, or theft.

Liability Insurance

Liability coverage protects the restaurant against claims for injuries or damages suffered by customers, employees, or third parties on the premises.

Workers' Compensation Insurance

This type of insurance is required in many places and covers medical expenses and lost wages for employees who are injured while performing their job.

Foodborne Illness Insurance

Restaurants may opt for this coverage to protect against claims related to foodborne illnesses that might be linked to the restaurant's products.

Business Interruption Insurance

This covers lost income and ongoing expenses if the restaurant is forced to temporarily close due to unforeseen events.

Liquor Liability Insurance

If the restaurant serves alcohol, this insurance can protect against claims arising from incidents involving intoxicated patrons.

Cyber Liability Insurance

In the digital age, this type of insurance can help cover costs associated with data breaches and cyberattacks.

Employee Theft Insurance

This coverage can provide financial protection against employee theft or embezzlement.

The cost of insurance varies based on factors like the restaurant's size, location, type of cuisine, and the level of coverage required. While insurance premiums add to the overall expenses, they provide crucial protection against unexpected events that could otherwise lead to significant financial losses. Restaurant owners need to carefully assess their insurance needs and choose coverage that aligns with their risk profile and budget.

6. Repairs and Maintenance

This includes the cost of regular maintenance and repairs to keep the restaurant's equipment and facilities in good condition. Repairs and maintenance costs can range from 2% to 6% of a restaurant's revenue.

7. Other Expenses

This includes other operating expenses, such as accounting and legal fees, credit card processing fees, and office supplies. Other expenses can range from 2% to 6% of a restaurant's revenue.

Restaurant Sample Cost Breakdown

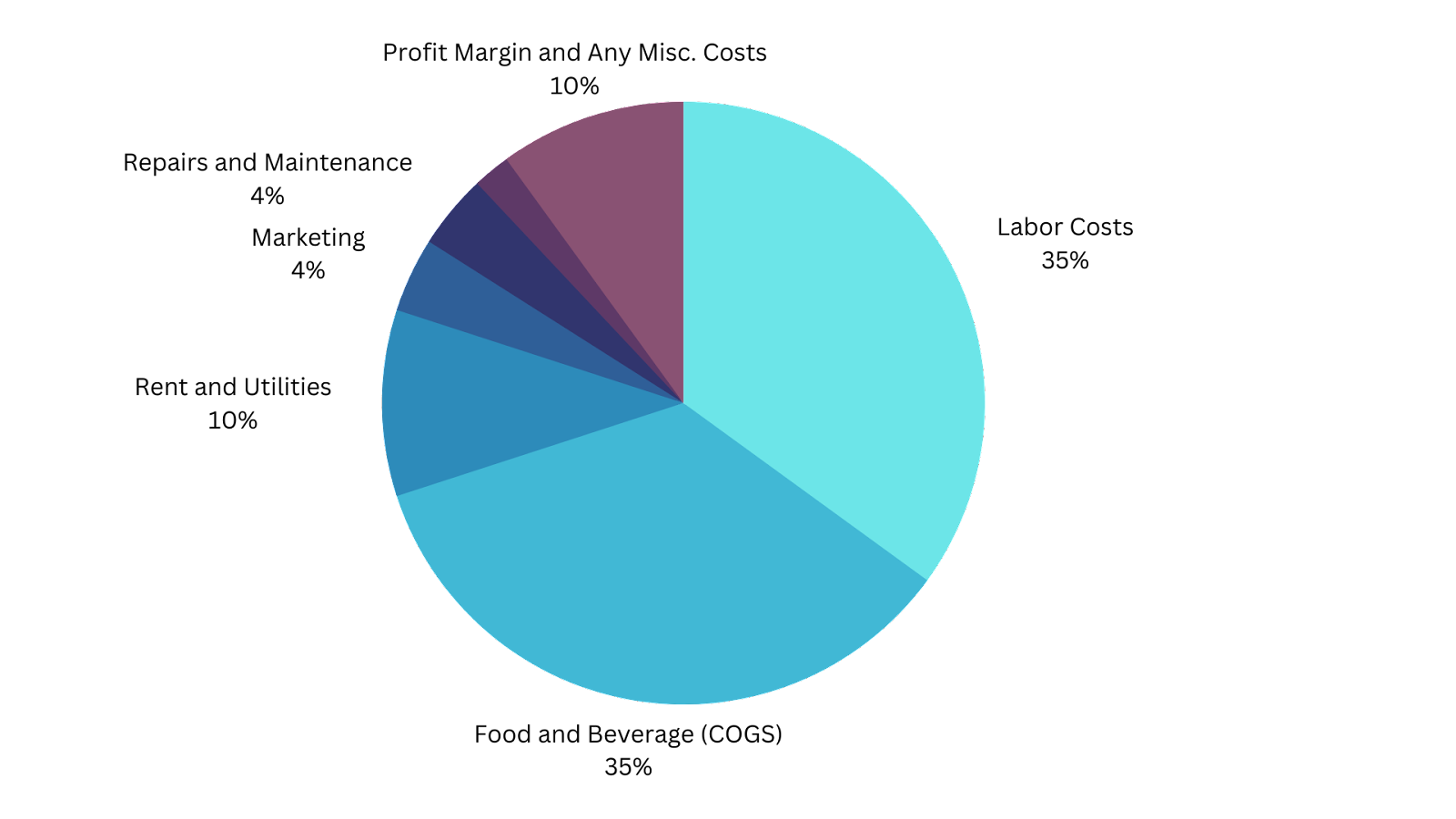

To better illustrate these values, check out the chart below that assigns a cost percentage to each main category. As you can see, labor and COGS should take up most of your costs. The more you can control these costs, the greater your profit margin.

It's important to note that these cost percentages can vary widely depending on a range of factors, such as the size and type of restaurant, its location, employee benefits, and the overall business model. However, these percentages for an average restaurant provide a general guideline for restaurateurs to plan and budget for their operating costs.

Prefer to look by month instead of year? Check out this monthly restaurant expense list.

Restaurant Startup Costs Breakdown

According to a survey conducted by Restaurant Owner, the initial investment required to open a restaurant can vary significantly, ranging from $175,500 to over $2 million.

Before you open a restaurant is a crucial time to break down your expected costs and ensure you’ll have enough coming in to keep running smoothly.

The exact costs of starting a restaurant can vary widely depending on a range of factors, such as the size and location of the restaurant, the type of cuisine, the food service model, and the level of experience of the restaurant owner. For example, an upscale full-service restaurant will have different initial expenses than a takeout-only pizza shop.

Let’s say, as an example, that your restaurant will bring in $500,000 in its first year. Keep in mind that this is just a general estimate and an even number to illustrate cost breakdowns. Where you fall for these values will vary depending on your business plan.

Toast found in a recent report that a restaurant under 12 months old can bring in roughly $111,860.70 each month. If this is the case for you, you can double these amounts.

Knowing all of this, here is a breakdown of the typical startup costs for a restaurant.

1. Food and Beverage Costs – While hard to predict at first, you’ll want to use the average food cost percentage range to gain a rough estimate of your beginning inventory costs. Of course, your ingredients play a huge role in how much of your budget will go toward COGS. Ideally, your menu prices reflect the quality of your restaurant and can help cover these costs.

Budget: $140,000 to $175,000

2. Labor Costs – Consider the cost of hiring and training employees, as well as any payroll taxes or benefits expenses associated with your staff. You’ll also need to budget to pay the right amount of staff for each shift. Whether you pay minimum wage or high hourly wages will impact your labor cost percentage.

Budget: Variable depending on the number of employees and hourly rates, but $125,000+ can be an example benchmark

3. Location and Rent – In addition to your monthly rent (or mortgage payments if you own your space), you should also factor in any associated fees. This might include security deposits, real estate commissions, property taxes, and more. It's common for restaurants to pay around 5-10% of their total sales in rent.

Budget: $25,000 to $50,000

4 Marketing and Advertising – Every restaurant today needs its own brand identity that can help draw in customers. For this expense, consider advertising and marketing activities you’ll take on, such as website development, printing menus and other promotional materials, and online marketing campaigns. Restaurants that are just starting out might opt for brand development (logo design) and some printed materials like signage and menus just to get up and running. At the very least, you’ll have some printing costs and time spent creating these materials.

Budget: $5,000 to $35,000

5. Equipment and Supplies – This includes the cost of all necessary equipment, such as kitchen appliances, refrigeration units, tables, chairs, glassware, and utensils, as well as the cost of initial inventory and supplies. This will be a substantial part of your upfront investment.

Budget: $100,000 to $300,000

6. Permits, Licenses, and Insurance – Remember to factor in the costs of obtaining any necessary permits and licenses required by local and state governments, such as health department permits, liquor licenses, and business licenses.

Budget: This can vary, but estimate $3,000+

7. Legal and Accounting Fees – This includes the cost of legal and accounting services required to set up and maintain your restaurant business, including the cost of registering your business, obtaining tax identification numbers, and filing necessary paperwork. Your accounting fees will likely be ongoing for payroll and tax preparation.

Budget: This can vary, but estimate $5,000 to $15,000

8. Working Capital – This includes the cash reserves you will need to cover any operating expenses until your restaurant begins generating revenue.

Did you add these up and wonder where your profit margin went? The truth is, in your first year, you might not make money.

According to Toast, “The fact is the vast majority of restaurateurs take on significant debt and achieve limited profitability when first starting out.”

That’s all the more reason to carefully budget for these expenses and to seek the advice of professionals to ensure that you are making the best decisions for your business.

Tips for Managing Restaurant Costs

Now that we have covered the types of costs and what you’ll need to get started, let's discuss some tips for managing your restaurant costs effectively.

Create a Budget

It�’s impossible to manage costs effectively without creating a budget. A budget will help you keep fixed expenses low, anticipate variable costs, and compare your spending over time. When creating your budget, leave room for unexpected and variable costs, such as the repairs mentioned above.

Monitor Inventory

According to the National Restaurant Association, restaurants can waste 4-10% of the food they buy. With inflation and current economic conditions, there’s even more reason to monitor your inventory and aim to minimize food waste. Through proper inventory management, you can identify which items are moving quickly and which items are sitting on the shelf. That way, you’ll be able to adjust ordering and reduce food costs for items that aren’t selling as quickly.

Analyze Sales Data

Your sales data is a gold mine when it comes to managing restaurant costs. Data from your POS system can illuminate slow days or hours so you can add promotions or special events and try to bring in more customers. Or, you can track sales data as the month progresses to anticipate your variable costs. This level of data can help you minimize and plan for the variable costs that are based on sales. The more you can optimize sales overall, the easier it is to cover the fixed costs you do have.

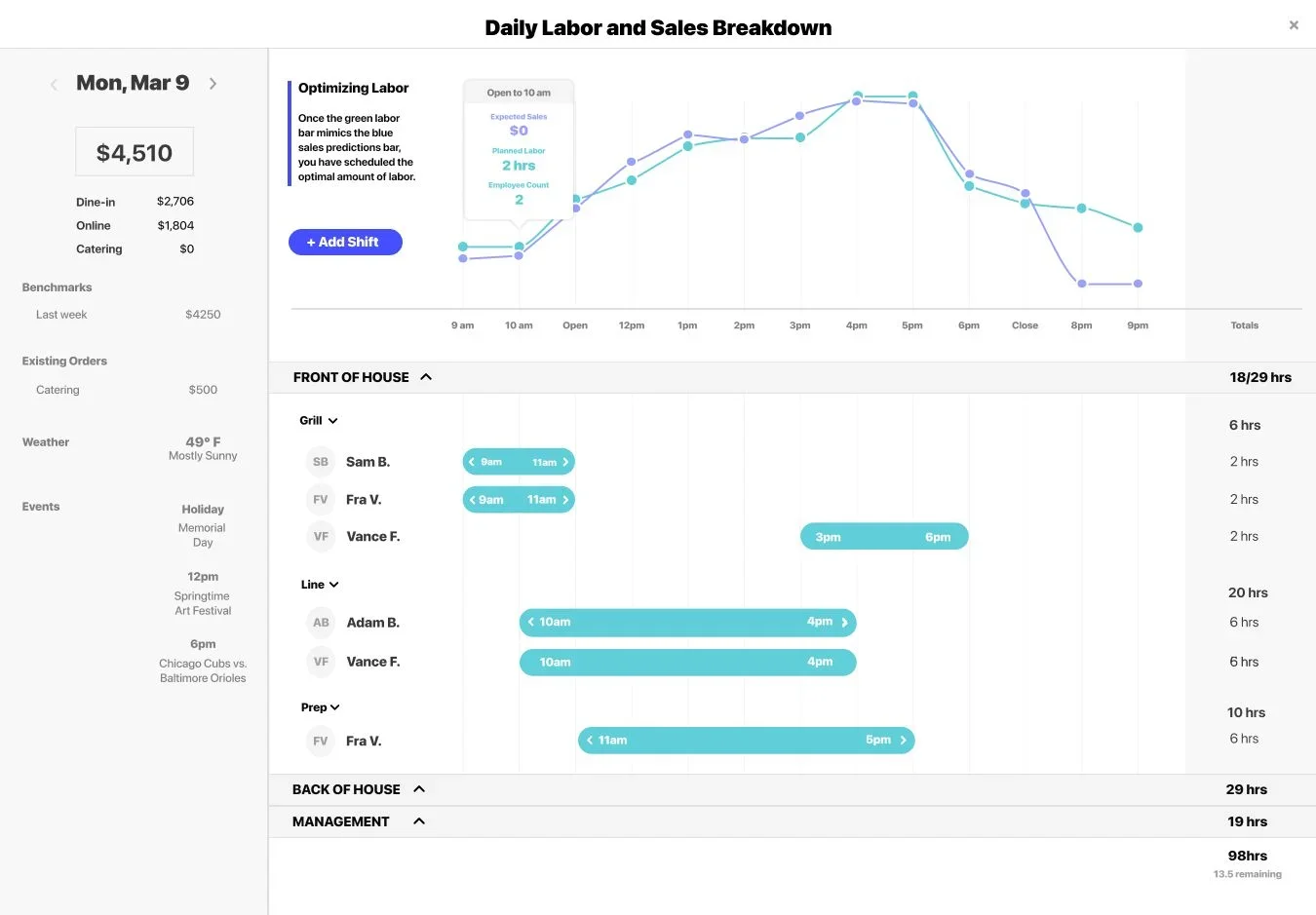

Lineup.ai's AI forecasting software eliminates the need for manual estimations and demand planning. This technology enables precise predictions for restaurant sales, demand, and workforce requirements. You can then schedule your restaurant staff based on these predictions with confidence.

Schedule Smarter

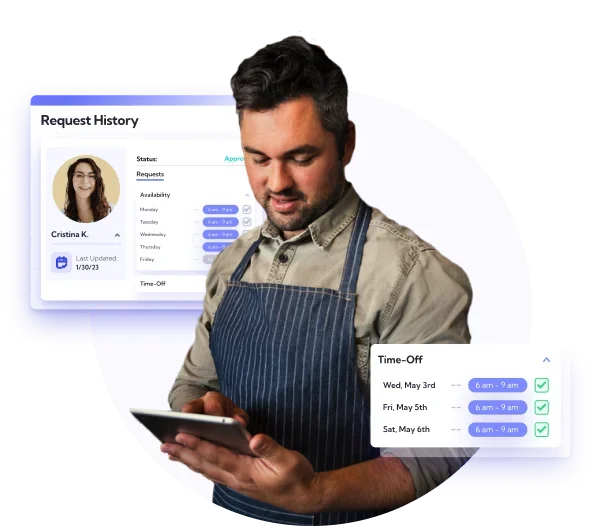

Your sales data comes in handy here, too. By closely monitoring your sales data, you can identify peak hours and days, forecast labor costs, and staff accordingly. This will help you avoid overstaffing during slow periods and understaffing during busy periods, which can result in a subpar customer experience. Adequately staffed shifts using automated restaurant scheduling software can also support employee retention by reducing the likelihood of burnout. With labor costing up to 35% of your total revenue, there’s a huge opportunity to optimize scheduling and reduce unnecessary labor costs.

Train Staff on Cost-Saving Techniques

There are a number of ways to get your staff thinking about cost-saving in their daily work. Take the time to teach your staff how to work efficiently and minimize waste so that everyone can contribute to your efforts. For example, you might have your line cooks come in and train on waste-reducing food preparation. Or, you can create side work lists for servers to tackle a deep clean when they have downtime. A greater focus on productivity can go a long way in saving time and money.

Get Key Restaurant Costs Under Control

With all of your other restaurant management duties, managing costs can feel like a daunting task. However, it is essential to keep a healthy bottom line, and for the long-term success of your business. By understanding the types of costs you will encounter, breaking them down into the right categories, and following these tips for managing them effectively, you can minimize your expenses and maximize your profits for a healthier balance sheet.

Creating a budget, monitoring your inventory, analyzing your sales data, scheduling smarter, and training your staff on cost-saving techniques are just a few ways to get started. As you go, remember to continuously monitor your costs and adjust your strategies as needed.

With these tips and a commitment to managing costs effectively, you can ensure the future success of your restaurant.

Good luck!

FAQs

What is the biggest expense for a restaurant?

The biggest expense in a restaurant is food, representing the primary variable cost, while the most significant semi-variable expense is labor.

What are the two main types of operating costs?

Two main types of restaurant operating costs are fixed and variable costs.

What is the average cost to start a restaurant?

Startup costs to establish a restaurant typically fall within a range of $175,000 on the lower end and can extend well beyond $700,000 on the higher end. The average expenses for starting a restaurant can vary significantly based on factors such as your location, equipment, furniture, and rent.

The team at Lineup.ai is composed of seasoned professionals who hold deep insights into the unique challenges and pain points of the restaurant industry, and are equally skilled in artificial intelligence, machine learning, and data analytics. This fusion of expertise enables Lineup.ai to create cutting-edge AI solutions specifically tailored for the restaurant sector. The technical and analytical prowess of the team, combined with a deep understanding of the unique challenges faced by restaurants, forms the cornerstone of the company's innovation. The team at Lineup.ai also excels in communicating the benefits and applications of AI and machine learning to businesses, ensuring clients fully leverage the capabilities of these solutions.

More about the author