One of the primary concerns for a restaurant owner or a manager is how the cost of running their business eats in their profit margin.

Labor cost is a significant portion of these restaurant expenses at around 30% average across the industry, and understanding how to calculate restaurant labor cost percentage can help you control costs and maintain a profitable operation.

Excessive spending on labor costs can significantly hinder your restaurant's profitability, even though there is flexibility in this allocation, particularly in fine-dining restaurants.

The better you understand your labor costs, the easier it will be to make adjustments to control them.

In this article, we will discuss what restaurant labor costs and labor cost percentage are and how to accurately calculate them.

What Are Restaurant Labor Costs and Labor Cost Percentage?

Restaurant labor costs are the expenses associated with hiring, training, and retaining employees. They include salaries, employee wages, taxes, benefits, and other related costs that are related to your restaurant’s workforce. Controlling your labor costs is essential to maintaining profitability, as they play a significant role in your restaurant's prime cost (prime cost is the sum of total labor costs and the cost of goods sold (COGS). It's a critical restaurant metric in determining profitability.)

Labor cost percentage is a key performance indicator (KPI) that shows the proportion of labor costs in relation to your restaurant's revenue or total operating costs.

Calculating labor cost percentage can help you assess the efficiency of your workforce and make informed decisions about staffing and scheduling.

How To Calculate Labor Cost Percentage

Learning how to calculate labor cost percentage will give you a better idea of the way your business both spends and makes money. You may want to consider your labor costs as they relate to other areas of your business, such as sales, operating costs, and more. In this section, we will cover several restaurant labor cost formulas that we think you will find the most useful.

1. Calculate Labor Cost As a Percentage Of Sales

To calculate labor cost percentage based on sales, use the following formula: Labor Cost Percentage = (Total Labor Cost / Total Sales) x 100

For example, if your total labor cost for a specific period is $10,000 and your total sales are $50,000, your labor cost percentage would be:

Labor Cost Percentage = ($10,000 / $50,000) x 100 = 20%

This formula allows you to track labor costs relative to your revenue, helping you identify areas where efficiency can be improved.

2. Calculate Labor Cost As a Percentage Of Total Operating Costs

Another way to calculate labor cost percentage is by comparing it to total operating costs. This formula takes into account all expenses related to running your restaurant, including rent, utilities, food/liquor costs, and marketing:

Labor Cost Percentage = (Total Labor Cost / Total Operating Costs) x 100

For example, if your total labor cost is $10,000 and your total operating costs are $60,000, your labor cost percentage would be: Labor Cost Percentage = ($10,000 / $60,000) x 100 = 16.67%

This approach gives you a comprehensive view of labor costs relative to all other operational expenses.

3. Calculate Labor Costs By Hours Worked

Lastly, you can calculate labor cost percentage based on hours worked. This formula helps you understand the productivity of your staff:

Labor Cost Percentage = (Total Labor Cost / Total Hours Worked) x 100

For example, if your total labor cost is $10,000 and your staff worked 1,000 hours, your labor cost percentage would be:

Labor Cost Percentage = ($10,000 / 1,000) x 100 = 1000%

This metric can help you optimize scheduling and ensure that you have the right number of staff during peak and off-peak hours.

Check out our free restaurant labor cost template.

Regularly reviewing and adjusting your labor cost percentage can help you stay competitive and profitable. Just keep an eye on your total revenue and profit margin, then decide what labor cost percentage you’re comfortable with.

Sales and Labor Forecast Calculator

Simply input your historical sales from the past four weeks along with your target labor cost, and this calculator will do the rest.

What Is a Good Labor Cost Percentage?

A good labor cost percentage varies depending on the type of restaurant and its location. For example, a fine-dine restaurant often requires more staff than a fast casual restaurant. However, industry experts generally suggest aiming for a labor cost percentage of around 20-30%. This range allows for a balance between maintaining efficient operations and providing quality service to your customers.

Average labor costs for quick service restaurants and fast casual restaurants is around 29%, while it’s a bit higher for casual dining at 33%. Upscale casual restaurants are right at the industry average of about 30%

Factors Impacting Labor Costs

Restaurant owners and managers need to understand the various factors that contribute to higher labor costs. Not all of them are as simple as the amount of money you pay workers. For example, things like employee turnover, overtime hours, training, and even scheduling are critical factors in maintaining a healthy labor cost percentage.

When you add in costs that aren’t related to labor, like food costs and restaurant maintenance, costs add up quickly. By monitoring and managing the most-important elements over a given period of time, you can optimize your labor cost percentage and improve your restaurant's bottom line.

Wage Rates

Wage rates are the hourly or salaried pay rates for your employees. They depend on factors such as experience, skills, and job role. There’s going to be a bit of variance on a restaurant payroll between bartenders, dishwashers, front-of-house, and back-of-house staff, and minimum wage isn’t the draw it used to be. Naturally, higher wage rates will result in increased labor costs and higher payroll taxes, so it's crucial to balance competitive pay with maintaining profitability. Higher pay attracts and retains better talent, just keep your bottom line in mind.

Make sure you comply with local and state labor laws.

Employee Benefits

In addition to wages, employee benefits also contribute to labor costs. Benefits may include health insurance, paid time off, and retirement plans. Offering competitive benefits is another practice that helps attract, and especially, retain top talent, but it can often be among the most costly. It’s a smart practice to shop around when considering your benefits structure, as there are many different providers in most areas.

Overtime

Overtime occurs when employees work more than the standard hours in a week or pay period. Overtime can significantly increase labor costs due to the higher pay rates for those extra hours. To control overtime costs, it's crucial to monitor employee hours and adjust schedules as needed. The accuracy of your sales and labor forecasts is crucial in avoiding overtime.

Employee Turnover

Employee turnover refers to the rate at which employees leave your restaurant and are replaced by new hires. High turnover can lead to increased labor costs due to recruitment, hiring, and training expenses. It can even cause customer service to suffer by forcing your restaurant to operate short-staffed. That’s why reducing turnover by improving employee satisfaction and providing growth opportunities can help lower labor costs.

Training and Development

Investing in employee training and development can improve the efficiency and productivity of your workforce. While training and development expenses contribute to labor costs, they can also lead to long-term cost savings by reducing turnover and improving overall performance. Putting together a more robust training program is a great way to establish consistency in one location or across several. It also gives you an opportunity to cross-train and provide your best employees with growth opportunities.

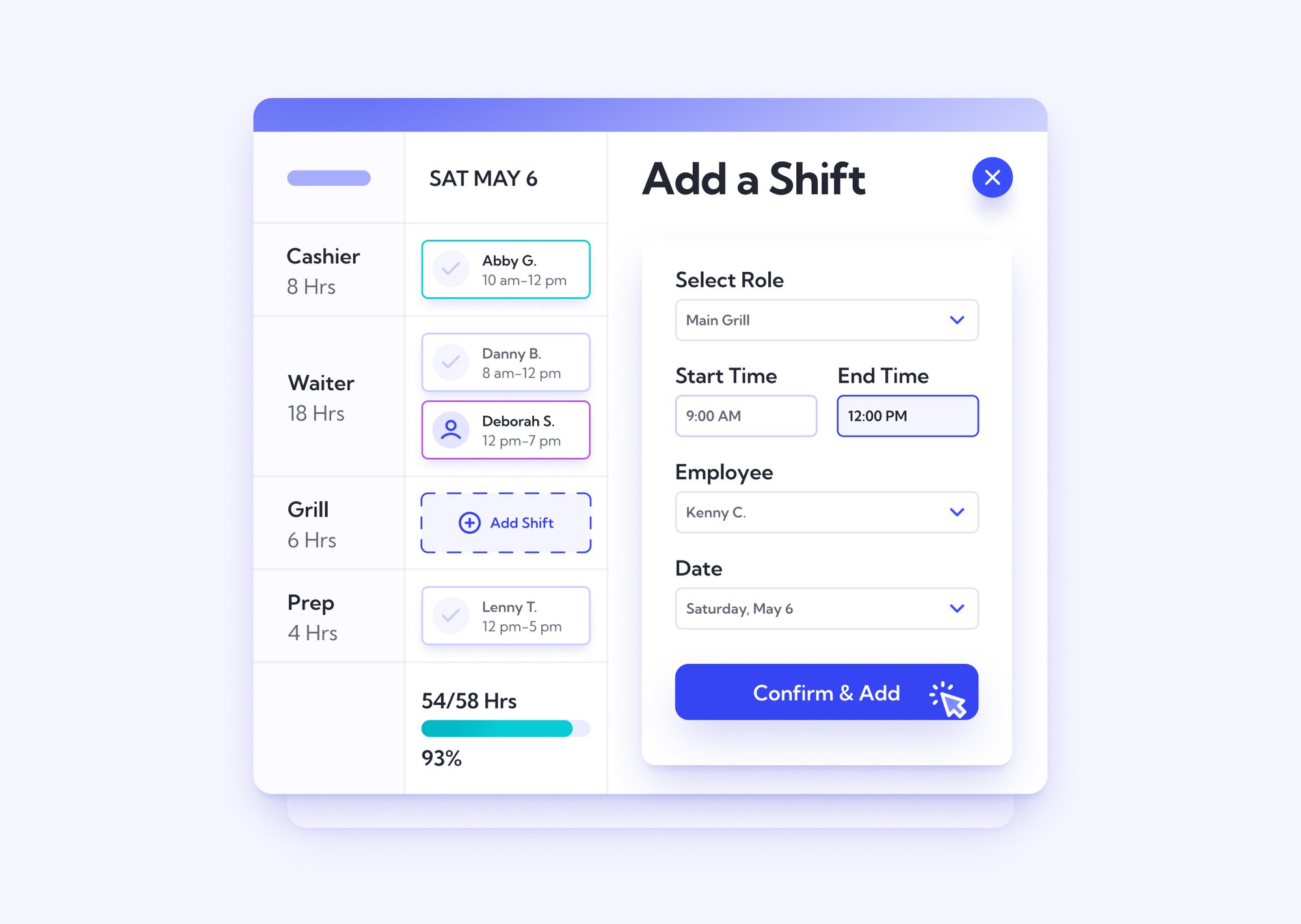

Scheduling

Effective scheduling can help you optimize your labor costs by ensuring that you have the right number of staff during peak and off-peak hours. Overstaffing leads to increased labor costs and less money in tips per employee, while understaffing can result in poor customer service and lost sales. Effective scheduling is one of the most important yet underutilized practices in controlling labor costs.

Consider utilizing restaurant employee scheduling software that integrates with your point of sale system to optimize the process.

Check out predictive scheduling regulations and laws in your state.

Stay On Track By Automating Labor Cost Calculation In Your Restaurant

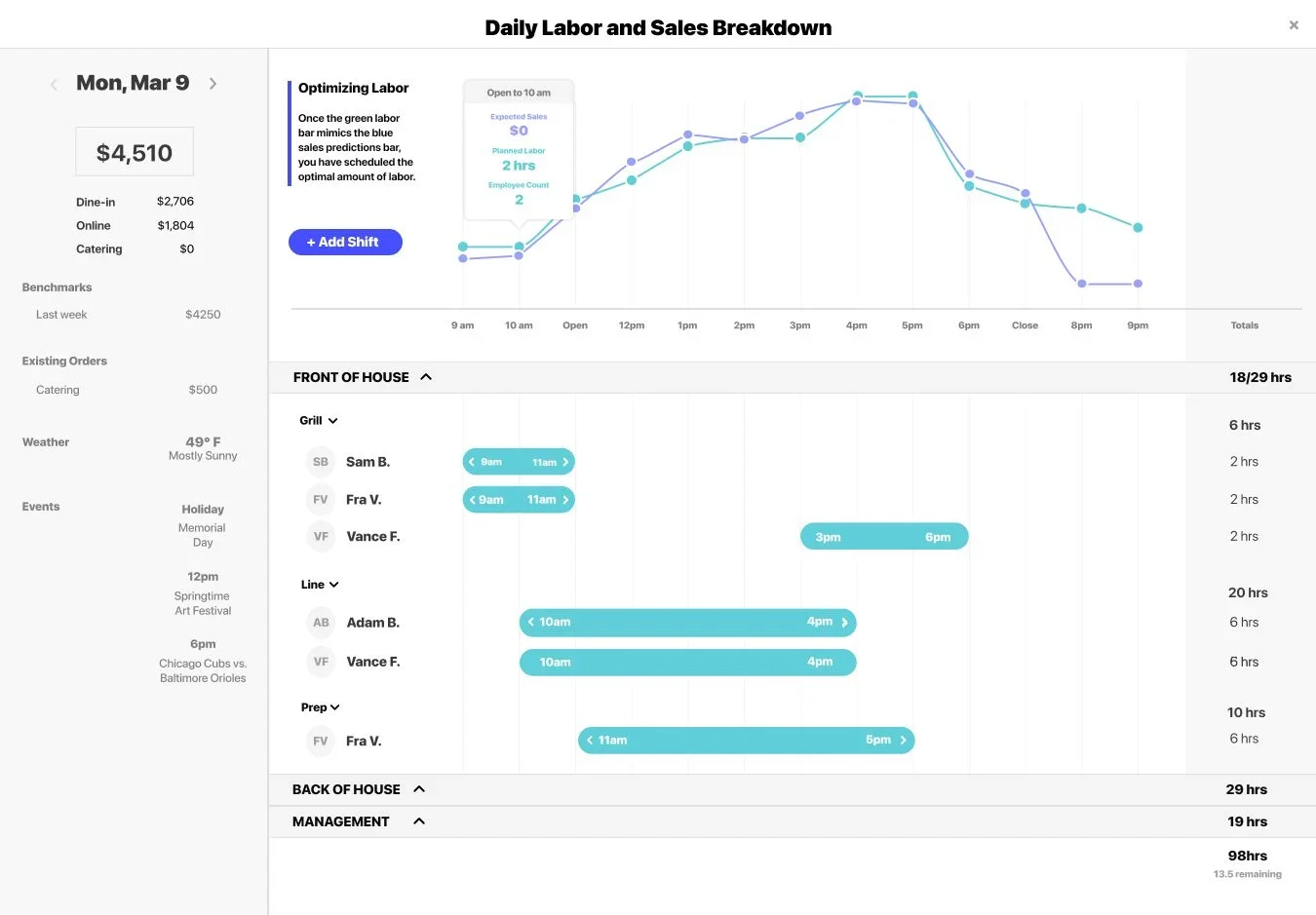

One of the best ways to keep labor costs low is by increasing the efficiency and accuracy of your sales and labor forecasts.

Avoid costly mistakes and the need for manual labor cost spreadsheets by using tools that can streamline processes and gain more accurate insights into labor costs and related data.

Lineup.ai uses historical sales and forward-looking data to provide restaurants with sales and labor forecasts, giving you a clearer picture of future demand.

This allows you to staff appropriately throughout the day and avoid overstaffing. You can make informed decisions about your workforce and keep your labor cost percentage under control. Lineup.ai allows you to set labor targets and view performance by role and location.

By automating these processes, you can quickly identify areas where improvements can be made, such as adjusting staff schedules, reducing overtime, or investing in training to increase efficiency. If one of your locations has a higher labor cost percentage, you can quickly identify it and get to the bottom of the issue.

With Lineup.ai, you can streamline your labor cost management and ensure your restaurant remains profitable.

Conclusion

Understanding how to calculate restaurant labor cost percentage is crucial for maintaining a successful and profitable business. By using the formulas provided in this article and regularly reviewing your labor costs, you can optimize your workforce and improve your restaurant's bottom line.

Additionally, leveraging automation tools like Lineup.ai can save you time and provide valuable insights into your labor costs, allowing you to make better-informed decisions about your staffing and scheduling needs.

FAQs

How to calculate labor cost per meal?

To determine labor cost per meal, simply divide the overall labor expenses by the quantity of meals served.

What should kitchen labor cost be in a restaurant?

The kitchen labor cost as a percentage of total restaurant revenue can vary depending on factors like restaurant type, location, and business model. However, a commonly used guideline is to aim for kitchen labor costs to be around 25-30% of total revenue. Here's the formula to calculate the kitchen labor cost percentage:

Kitchen Labor Cost Percentage = (Kitchen Labor Costs / Total Revenue) x 100

How to calculate labor cost in a recipe?

Measure the employee's cooking duration, then calculate the labor cost by multiplying this time by her hourly wage. However, achieving a precise estimate requires considering additional factors like food cost per dish, labor skill level, employee salaries, and the extent of cross-training.

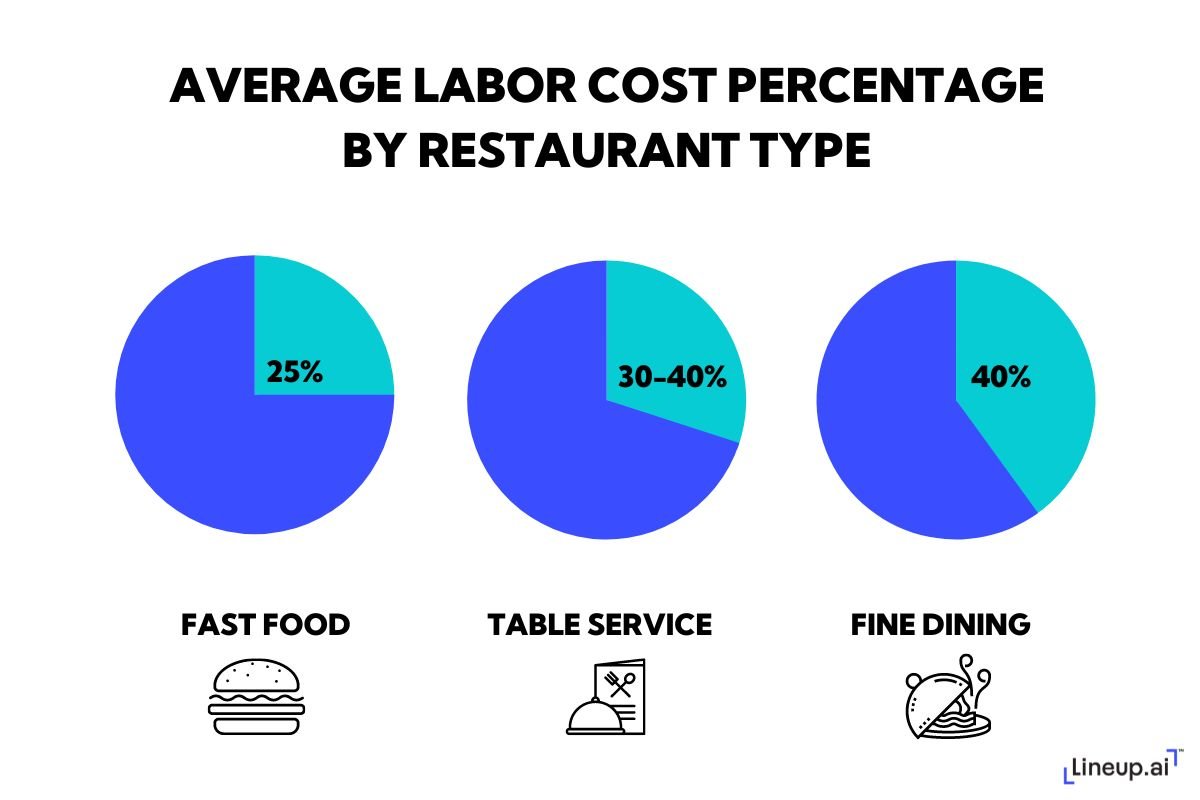

What is average labor cost by restaurant type?

- Fast-food restaurants: 25%

- Fine dining: 30% to 40% of higher

- Table service restaurants: 30%-40%

Why is my labor cost so high?

The variety of dishes offered in your restaurant can influence labor costs. A restaurant offering an extensive menu will need a larger team, leading to increased labor expenses. Additionally, the seasonal trends can also have an impact on labor costs.