You don’t need to search very hard to find examples of times when understanding cash flow was crucial to a restaurant’s survival. For example, understanding exactly how much cash was coming in, going out, and available at the start and end of the week or month saved a lot of restaurants during the pandemic. Cash flow forecasting is a vitally important aspect of running a successful restaurant.

Predicting incoming (cash inflows) and outgoing cash (cash outflows) allows restaurant owners to make informed decisions regarding future expenses, investments, and growth opportunities. It also helps them budget during times of unforeseen disruption. Using a cash flow forecast template streamlines this process, making it easier to manage the financial aspects of the business.

The Cash Flow Projection Template for Restaurants

Download our free template to create your restaurant's cash flow forecast, incorporating cash inflows and outflows:

Cash Flow Forecast Template Download

Fill in the appropriate values for each category based on your forecasts, and calculate the net cash flow by subtracting total cash outflows from total cash inflows.

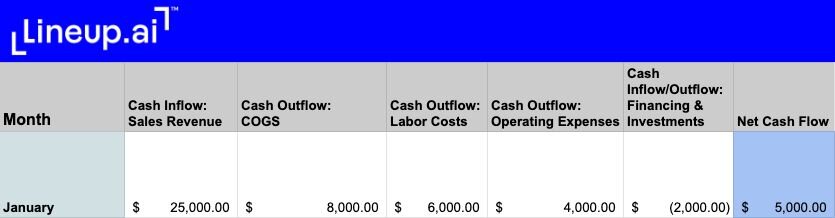

Here's a simplified example of how to use the template.

Let's say you're forecasting for the month of January:

Here's the breakdown of this example:

- Cash Inflows: Sales Revenue

This is the total expected revenue from all food, and beverage sales, and any events or catering services. For this example, let's say you expect $25,000 in sales revenue for June.

- Cash Outflows: COGS

This would include the cost of food and beverage ingredients, as well as any packaging supplies. In this example, we'll assume this comes to $8,000.

- Cash Outflows: Labor Costs

This includes the wages for your staff, as well as any associated taxes and benefits. For this scenario, we'll say this amounts to $6,000.

- Cash Outflows: Operating Expenses

This includes rent, utilities, marketing expenses, insurance, licenses, and maintenance costs. We'll assume this comes to $4,000 for June.

- Cash Inflows/Outflows: Financing & Investments

This covers loan payments, dividends, or any investments. In this case, we have a loan payment of $2,000, which is an outflow, hence it's represented as a negative number.

- Net Cash Flow

This is calculated as total cash inflows minus total cash outflows ($25,000 - $8,000 - $6,000 - $4,000 - $2,000 = $5,000). This means you're expecting to have a positive cash flow of $5,000 for June.

This table should be filled out for each period (usually monthly) that you're forecasting. By doing this, you'll get a clear picture of your restaurant's cash flow and can make necessary adjustments to maintain positive cash flow.

While it’s good practice to fill out each month as the data becomes available, you’ll want to revisit the numbers periodically in case your projections change. Anyone who has been in the restaurant business for long enough knows how quickly the financial model can change. Business owners need to continue to project cash flow and update those projections to more accurately plan ahead.

Essential Components of the Restaurant Cash Flow Forecast Template

It doesn’t matter if you’re part of a huge restaurant group or you own and operate a small business. Every company has a break-even point they need to stay above. A well-structured cash flow forecast template should include the following components and metrics:

Sales Revenue (Cash Inflows)

Sales revenue is the primary source of cash inflow for a restaurant. It is crucial to forecast sales revenue accurately, taking into account factors like historical sales, seasonality, and competition. For a more in-depth look at sales forecasting, check this out. There are several subcategories within sales revenue:

- Food sales: The revenue generated from selling food items.

- Beverage sales: The revenue generated from selling alcoholic and non-alcoholic beverages.

- Catering and events: The revenue generated from providing catering services or hosting events at your restaurant.

Cost of Goods Sold (COGS) (Cash Outflows)

COGS represents the direct costs associated with producing the food and beverages sold by the restaurant. These costs directly impact the gross profit margin and cash balance and should be carefully managed. The COGS category includes:

- Food costs: The cost of ingredients and raw materials used in preparing food items.

- Beverage costs: The cost of alcoholic and non-alcoholic beverages served at the restaurant.

- Supplies and packaging: The cost of items like disposable containers, napkins, and other packaging materials used in the restaurant.

Labor Costs (Cash Outflows)

Of course, business cash flow requires paying workers to operate your business. Labor costs are a significant expense for restaurants. Effective staff management and accurate forecasting of labor costs are essential for maintaining profitability. Labor costs include:

- Salaries and wages: The total cost of employee salaries, hourly wages, and tips.

- Payroll taxes and benefits: The cost of payroll taxes, insurance, retirement plans, and other employee benefits.

- Training and development: The cost of ongoing employee training and development programs.

Operating Expenses (Cash Outflows)

Operating expenses are the indirect costs associated with running a restaurant. These expenses are necessary for the day-to-day functioning of the business but are not directly tied to the production of goods or services. Still, they factor heavily into a restaurant budget. Operating expenses include:

- Rent and utilities: The cost of renting the restaurant space and utility expenses such as electricity, gas, and water.

- Marketing and advertising: The cost of promotional efforts, including online and offline advertising, social media marketing, and public relations.

- Insurance and licenses: The cost of insurance premiums and required licenses to operate the restaurant.

- Maintenance and repairs: The cost of keeping the restaurant in good working order, including cleaning, equipment maintenance, and repairs.

Financing and Investments (Cash Inflows and Outflows)

Financing and investments are cash inflows and outflows related to the financial aspect of the restaurant. These include:

- Loans and interest payments (Cash Outflows): The cost of repaying loans to a lender and the interest associated with them.

- Owner's draw or dividends (Cash Outflows): Money receivable to the restaurant owner or investors as a return on their investment.

- Capital expenditures (Cash Outflows): Investments in long-term assets like property, equipment, or significant renovations.

Steps To Create Cash Flow Projection for Your Restaurant

Creating a restaurant cash flow forecast involves the following steps:

Step 1: Gather Historical Financial Data

Collect past financial statements, including income statements, balance sheets, and cash flow statements, to inform your forecast.

Step 2: Identify Trends and Seasonality

Analyze historical data to identify trends and seasonality patterns that could impact future cash inflows and outflows. Consider factors such as peak seasons, holidays, and local events.

Step 3: Forecast Future Revenue and Expenses

Based on historical data, trends, and seasonality patterns, estimate future cash inflows (revenues) and cash outflows (expenses) for each category. Ensure that each sales forecast is realistic and takes into account any planned changes to the business, such as menu updates or expansions.

Step 4: Evaluate Financing and Investment Options

Assess your restaurant's current financial situation and determine whether additional financing or investments are necessary. Consider the potential impact on cash flow and weigh the benefits against the costs.

Step 5: Monitor and Update the Forecast Regularly

Continuously track actual financial performance against your cash flow forecast and make adjustments as needed. This will help you identify potential issues early and make informed decisions to keep your restaurant financially healthy.

A Better Way to Predict Cash Flow

Embracing technology can significantly simplify and improve the accuracy of your cash flow predictions. Lineup sales forecasting software is a comprehensive tool designed to aid in this process. With advanced restaurant reporting and analytics and intuitive features, Lineup.ai allows you to forecast sales revenue, predict demand, and manage labor to a percentage of sales.

Using cutting-edge AI and machine learning, Lineup.ai adjusts your forecasts based on seasonality, historical sales, local weather and events, and more. By automating the forecasting process, Lineup not only saves valuable time but helps ensure your financial planning is based on the most reliable data. With its robust capabilities and user-friendly interface, Lineup.ai empowers restaurant owners to take control of their financial future. Find out more about Lineup forecasting software.

Further read: